Prepared Data Description

Table of N by Year

|

Year

|

N

|

Weighted-N |

Unit of Observation

|

|---|---|---|---|

| 2009 | 24,864 | 24,864 | Property/Housing-Unit |

|

2010 |

25,317 | 26,013 | Property/Housing-Unit |

| 2011 | 25,659 | 26,361 | Property/Housing-Unit |

| 2012 | 26,130 | 26,832 | Property/Housing-Unit |

| 2013 | 26,591 | 27,294 | Property/Housing-Unit |

Data Elements (Click or Scroll Down to see Description)

- Property Type

-

Number of Units in Building

- Year Built

- Number of Bedrooms

- Presence of a Bathroom

- Total Value Amount

- Total Value Amount in Constant 2013 Dollars

- Taxes

- Taxes in Constant 2013 Dollars

Note:

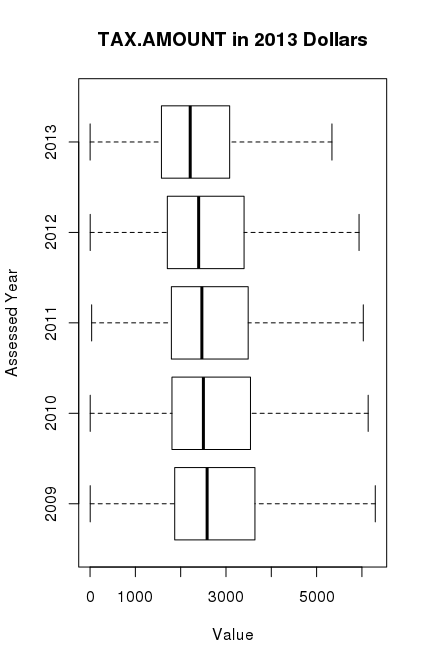

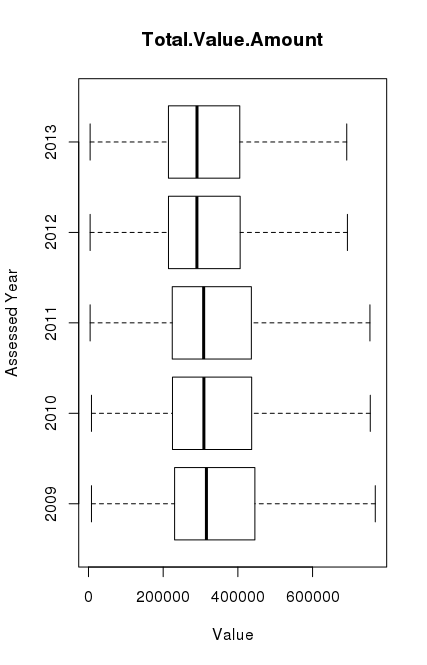

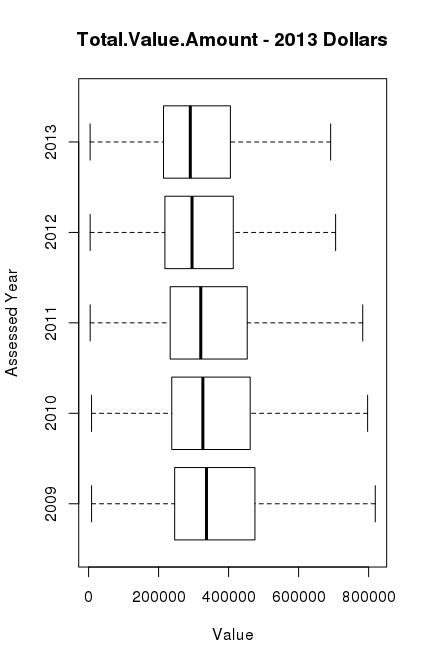

The box plots presented below have outliers hidden. A box plot is a graphical rendition of statistical data based on the minimum, first quartile, median, third quartile, and maximum.

Property Type

Variable: PropertyTypeACS

Population: Residential properties with a building

Weights: Values were weighted base on number of units

Class: Factor

Frequency Table:

| Weighted N | Missing |

Condo |

Mobile Home |

Multifamily |

Single Family-Attached |

Single Family - NEC |

||

|---|---|---|---|---|---|---|---|---|

| 2009 | 24,864 | 0 | 794 | 1 | 152 | 23,906 | 11 | |

| 2010 | 26,013 | 0 | 820 | 0 | 850 | 24,342 | 1 | |

| 2011 | 26,361 | 0 | 841 | 2 | 861 | 24,642 | 15 | |

| 2012 | 26,832 | 0 | 927 | 2 | 861 | 25,031 | 11 | |

| 2013 | 27,294 | 0 | 987 | 2 | 861 | 25,435 | 9 |

Number of Units in Building

Variable: NumberofUnitsACS

Population: Residential properties with a building

Weights: Values were weighted base on number of units

Class: Factor

Frequency Table:

| Weighted N | Missing |

1-Attached |

1-Detached |

2 Units |

3 or 4 units |

5 to 9 units |

10 to 19 units |

20 to 49 units |

50 or more Units | Unknown | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2009 | 24,864 | 0 | 794 | 23,906 | 0 | 0 | 0 | 0 | 0 | 0 | 164 | |

| 2010 | 26,013 | 0 | 806 | 24,263 | 0 | 23 | 58 | 124 | 0 | 604 | 135 | |

| 2011 | 26,361 | 0 | 827 | 24,562 | 2 | 34 | 57 | 124 | 0 | 602 | 153 | |

| 2012 | 26,832 | 0 | 913 | 24,950 | 2 | 35 | 57 | 124 | 0 | 602 | 149 | |

| 2013 | 27,294 | 0 | 973 | 25,354 | 2 | 36 | 57 | 124 | 0 | 602 | 146 |

Year Built

Variable: YearBuiltACS

Population: Residential properties with a building

Weights: Values were weighted base on number of units

Class: Factor

Frequency Table:

| Weighted N | Missing |

1939 or earlier |

1940 - 1949 |

1950 - 1959 |

1960 - 1969 |

1970 - 1979 |

1980 - 1989 |

1990 - 1999 |

2000 - 2009 |

2010 or later |

||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2009 | 26,6242 | 240 | 378 | 197 | 723 | 1,134 | 2,347 | 5,507 | 6,268 | 8,070 | 0 | |

| 2010 | 25,353 | 660 | 392 | 201 | 723 | 1,140 | 2,417 | 5,529 | 6,352 | 8,350 | 249 | |

| 2011 | 25,710 | 651 | 393 | 199 | 724 | 1,139 | 2,417 | 5,529 | 6,350 | 8,382 | 557 | |

| 2012 | 2,6227 | 605 | 371 | 202 | 725 | 1,135 | 2,419 | 5,528 | 6,350 | 8,394 | 1,103 | |

| 2013 | 26,701 | 593 | 356 | 204 | 729 | 1,135 | 2,420 | 5,523 | 6,347 | 8,408 | 1,579 |

Number of Bedrooms

Variable: BedCountACS

Population: Residential Dwellings with a building

Weights: Values were weighted base on number of units

Class: Factor

Frequency Table:

| Weighted N | Missing | 0 | 1 | 2 | 3 | 4 | 5 or more | ||

|---|---|---|---|---|---|---|---|---|---|

| 2009 | 21,821 | 3,043 | 0 | 190 | 2,370 | 11,729 | 6,671 | 761 | |

| 2010 | 22,316 | 3,697 | 0 | 192 | 2,463 | 11,976 | 6,904 | 781 | |

| 2011 | 22,696 | 3,665 | 0 | 193 | 2,516 | 12,172 | 7,002 | 813 | |

| 2012 | 23,349 | 3,483 | 0 | 191 | 2,580 | 12,472 | 7,241 | 865 | |

| 2013 | 23,965 | 3,329 | 0 | 196 | 2,647 | 12,742 | 7,453 | 927 |

Total Value Amount

Variable: X.TOTAL.VALUE.CALCULATED.

Years: 2009-2013

Population: Residential properties with a building that had an assessment conducted

Exclusion: Removed those classified as multifamily and unknown affordable dwelling. (Renters do not get asked real estate tax questions)

N: See table above for N

Number missing: 0

Class: Numeric

Range: 4,400 – 4,385,900

Standard Deviation: 211,080

Total Value Amount in Constant 2013 Dollars

Variable: Total.Value.Amount.Constant2013

Years: 2009-2013

Population: Residential properties with a building that had an assessment conducted

Exclusion: Removed those classified as multifamily and unknown affordable dwelling. (Renters do not get asked real estate tax questions)

N: See table above for N

Number missing: 0

Class: Numeric

Range: 4, 400 – 4,677,737

Standard Deviation: 219,329

Taxes Paid

Variable: X.TAX.AMOUNT.

Years: 2009-2014

Population: Residential properties with a building that had an assessment conducted during the year

Exclusion: Removed those classified as multifamily and unknown affordable dwelling. (Renters do not get asked real estate tax questions)

N: See table above for N

Number missing: 1,540

Class: Numeric

Range: 1.54 – 33,771.44

Standard Deviation: 1,647.26

Taxes Paid in Constant 2013 dollars

Variable: TAX.AMOUNT.2013

Years: 2009-2014

Population: Residential properties with a building that had an assessment conducted during the year

Exclusion: Removed those classified as multifamily and unknown affordable dwelling. (Renters do not get asked real estate tax questions)

N: See table above for N

Number missing: 1,540

Class: Numeric

Range: 1.54 – 36,018.59

Standard Deviation: 1,710.73